See How The Winter Starts With Sheer Optimism

Somehow the investment winter starts with sheer optimism. Because of an important news event, the market sentiment showing some risk factors. Mainly, the vaccine optimism and encouraging data from China has made the trading chart unpredictable for traders.

The American biotechnology company Moderna announced with clear statistics that the vaccination will be 94% effective to COVID-19 patient. They stated that it would also fight against severe types of diseases with no objection.

However, both Moderna and Pfizer vaccines are eagerly waiting for FDA authorization. On the other hand, China’s Manufacturing and Services PMI reports, unfortunately, beats all expectations.

Thus, the economic activity renounce of the world’s second-largest economy has encouraged investors.

Stock S&P 500 Chart Analysis

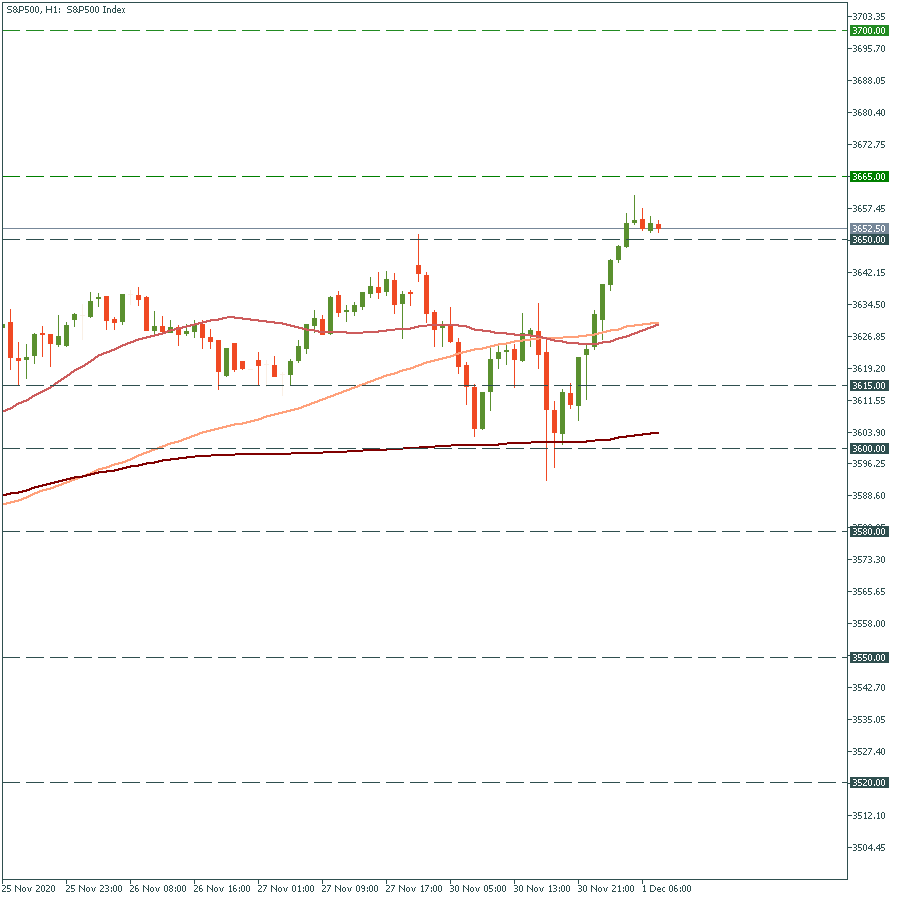

And all this pragmatic news results in moving the S&P 500 upward. The chart showed that it is about to touch an all-time high of 3665. Also, it met a selling pressure just above 3650.

However, if it can break 3,665 anyhow, the road up to the next round number of 3,700 will be clear. The downward movement of the low of November 30 at 3,615 will push the S&P 500 to the support of 3,600.

Popular Currency Pair EUR/USD

A combination of Chicago PMI report and the US home sales appear with a worse scenario than the forecasts. The forecast added pressure on the greenback. However, the most popular currency USS is trading at the lowest level since April 2018.

Though the day before today, the prominent currency pair EUR/USD touched the critical resistance of 1.2000, yet couldn’t break it. Now it’s heading towards the same direction once more, but it may meet the barrier at 1.1975.

On the flip side, the downward movement of yesterday’s low of 1.1925 will push the pair to the 50-period moving average of 1.1900.

The Precious Metal Gold

Gold is moving higher. But it may meet the resistance of Friday’s high at $1,790. If it breaks the level, it may jump to the level of $1,800. Or else, the opposite move towards $1,765 will drive the yellow metal to $1,750.

Oil

Yesterday, OPEC+ members disagreed on further output cuts. It causes the oil price to drop. Today they will meet again for the second time. If the WTI oil drop below the recent highs of $44.70, the way down to the 50-period moving average of $44.00 will be open.

On the contrary, the move above the resistance of $46.00 will push the price to the next round number of $47.00.

Finally, it is advisable to all traders, before starting your day, check the economic calendar.