Technical Analysis versus Fundamental Analysis Of Binary Options

Technical analysis vs Fundamental analysis. It’s a highly debated topic with traders from both sides claiming their analysis method to be better.

Whether it is to make a living or for just the sake of side income, if you have chosen binary options for trading, the decision is right if you have the passion for the same.

There should be a lot of dedication and effort from every trader to be successful in this industry.

Many beginner traders with minimum trading knowledge are earning well with the help of auto trading platforms and with the help of signals and other indicators.

But the survival in this field for a long term you should know binary options, how the trading technique works and also, you will need a lot of market knowledge.

Coupled with knowledge, analysis plays a significant role in trading. There are three categories of study:

- Technical Analysis

- Fundamental Analysis

- Sentiment Analysis

We will explain the technical and fundamental analysis in this article. However, trading analysis is the bread and butter of any trader’s trading regimen.

You need to know how these two differ and the role they play in analyzing the market. Ultimately, to trade profitably, you need to perform both. Let us first understand what technical analysis is.

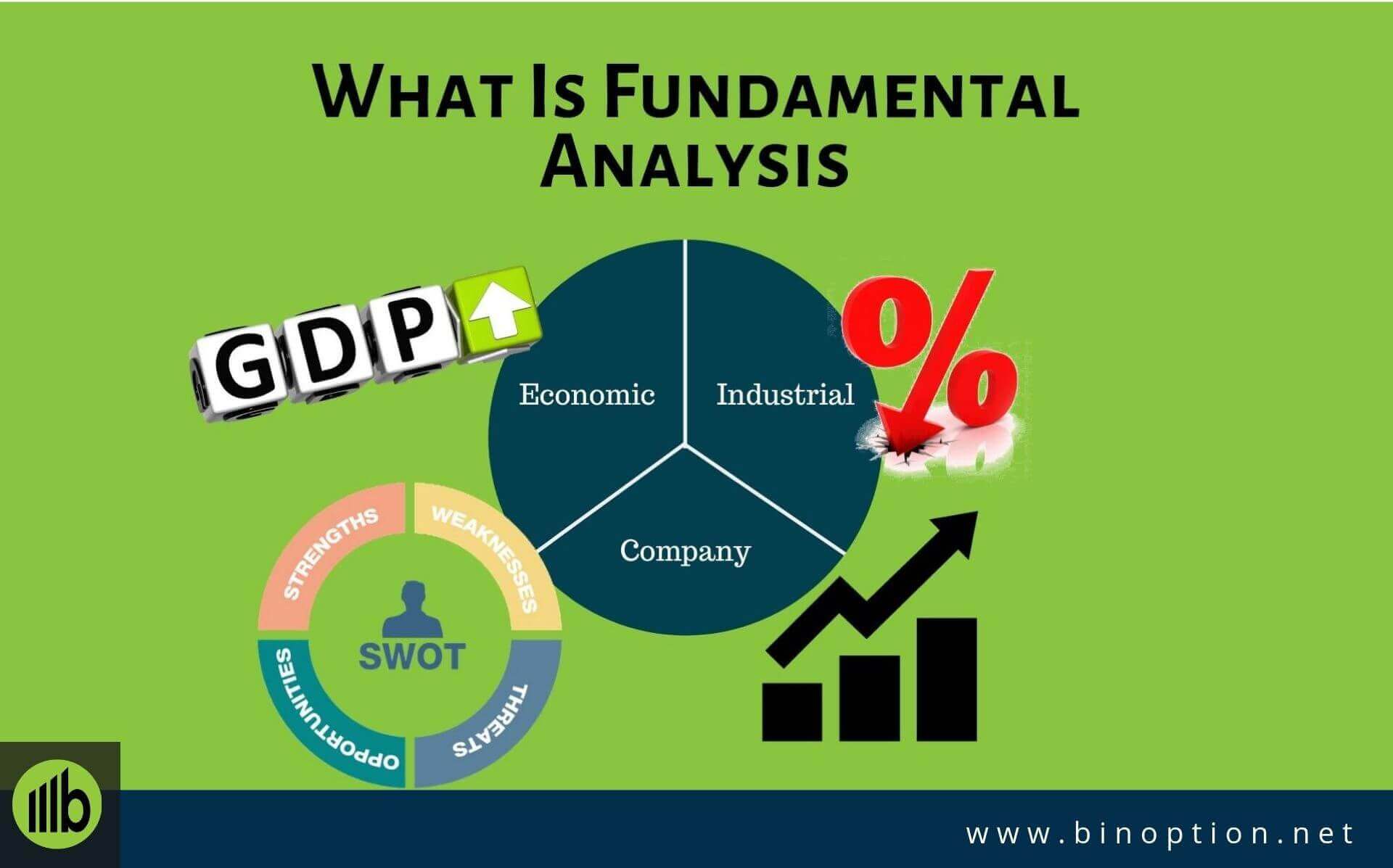

What Is Fundamental Analysis?

Binary Options offers multiple trading asset types. This includes forex pairs, cryptocurrencies, commodities, indices, stocks, and more.

Each of these asset type has hundreds of different types of assets. Each asset has its own market which is influenced by several factors.

Fundamental analysis is nothing but analyzing these internal and external factors to analyze the asset market.

This analysis results in an evaluation of the intrinsic value of the asset. The factors mentioned here are all the factors outside the price movement of the asset.

So what are the factors affecting the price of the asset? It completely depends on the type of asset. Like we previously mentioned binary options offer multiple asset types.

So if you trade stocks, then you will look at the details of the company whose stock you are trading.

Company analysis can include competitive advantage, revenue, growth rate, market share, profit margin, SWOT, Earnings Per Share (EPS), etc.

Generally, there are 3 broad categories of fundamental analysis:

- Economic analysis

- Industrial analysis

- Company analysis

We discussed the company factors above. Economic analysis includes GDP, inflation rate, interest rate, budget, tax rate, demographic factors, inter-country relations, etc.

Industrial analysis includes product analysis, industry growth rate, product competition, tax structure, import and export duties, technological advancement, industry life cycle, etc.

There are other factors such as political, demographics, etc that are also considered in fundamental analysis.

Combining these factors, a trade predicts the future value of the asset. Technical analysis is also used to do the same, but then how is it any different?

What Is Technical Analysis?

Technical analysis involves predicting future prices of assets using historical price charts and market price data.

Technical analysis is based on the premise that history will repeat itself and there is a trend for every asset.

These patterns and trends are analyzed using trading tools such as indicators, trend lines, and other graphical tools.

Accurate prediction of these trends and patterns will result in winning trades. At the end of this analysis, if a downtrend is detected, the trader will sell, and in the case of an uptrend, the trader would buy.

Old school traders strongly believe in fundamental analysis alone but technical analysis has proven to be critically useful in predicting the future market prices from past prices.

Let us see what tools are used for performing technical analysis:

Technical Indicators:

Technical Indicators are mathematical calculations plotted on the chart. They are based on price data, market volume, and other factors.

Some of the popular indicators include Moving Average, MACD, EMA, Bollinger Bands, RSU, Parabolic SAR, etc. You can use a single indicator on the chart or a combination of multiple indicators. It all depends what kind of analysis you are looking for.

There are two types of indicators available: overlay and oscillator.

Overlay indicators are plotted on top of the trading chart whereas oscillators below the price chart.

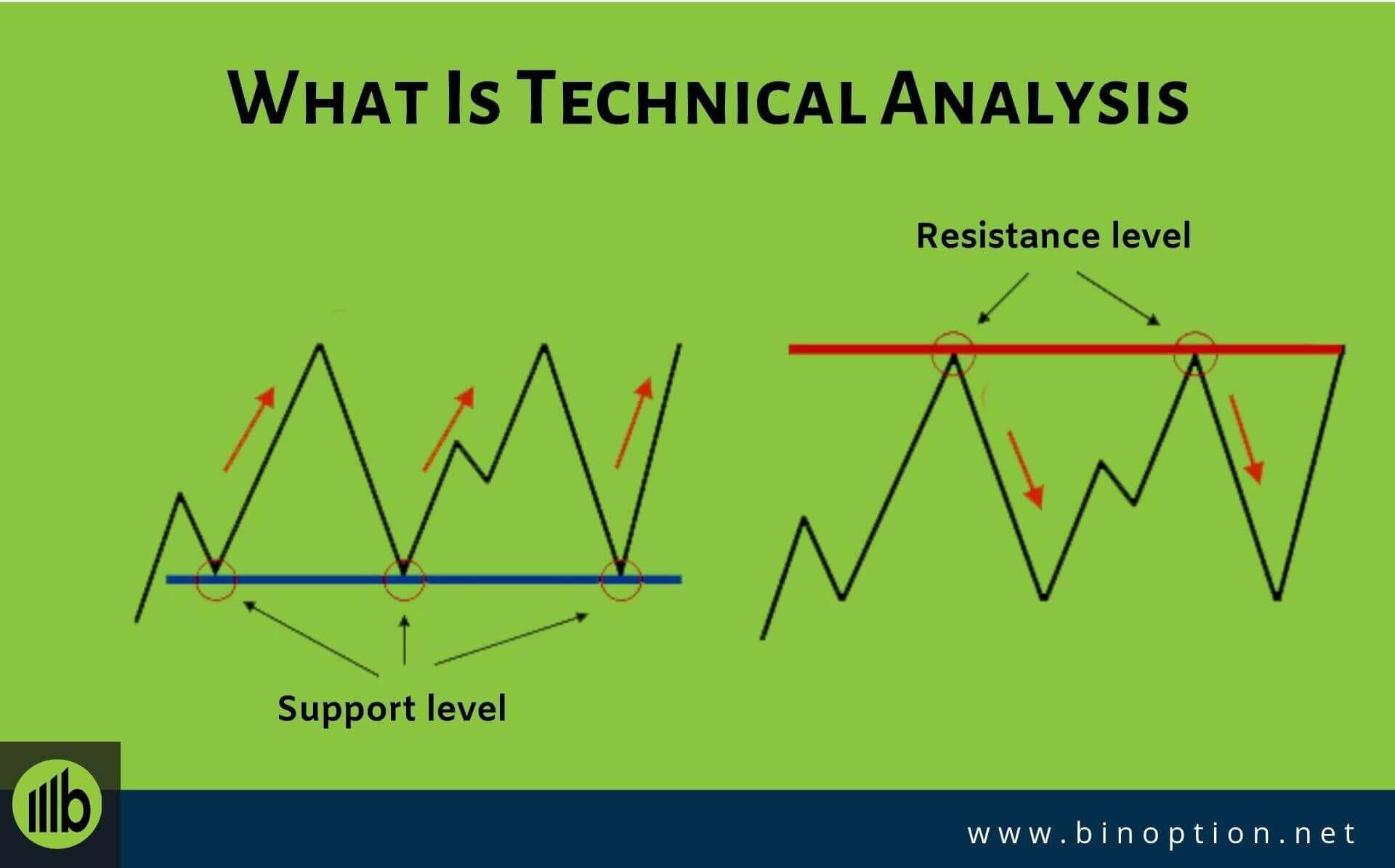

Trend Lines

Trend lines are lines plotted in a price chart to identify trends and breakouts. Two of the most common trend lines are support and resistance level.

Support line is the price level from where a downtrend is expected to reverse into an uptrend. Resistance line is the price level from where the uptrend is expected to reverse into a downtrend.

With trend lines, you can also draw vertical and horizontal lines. Normally, at least two points are required to form a line. But, when plotting trend lines, at least three are recommended.

Technical vs Fundamental Analysis: Which Is Better?

We have discussed how both forms of analysis work. This comparison is long on-going debate as to which is better.

One one hand, we have traders who believe in reading charts and analyzing trends. On the other hand, there are traders who prefer to take economic, industrial, and company factors to make trading decisions.

We are here to tell you, to maximize your results, you need the combination of both these analysis.

Granted, you can perform any one with excellence and get your desired results, but combining both will get you the best of both the worlds.

We will list you some pros and cons of both these methods to give you a deeper insight.

Advantages of fundamental analysis includes a complete overview that includes economic, technological, political, demographic factors.

Moreover, you get a deeper understanding of how the company you invest functions.

On the other hand, technical analysis gives you precise entry and exit points. You also get a clear insight on the supply and demand of of the underlying asset.

Technical analysis also gives you a historical price data that allows you to compare with the existing price.

Final Words

We have analyzed the two forms of analysis that are used on trading. Trading binary options can be made profitable by forming a reliable strategy.

And this strategy can only be formed when you analyze the market. In conclusion, use both forms of analysis.

One way of confirmation before placing a trade would be to compare your result from technical and fundamental analysis.

This way your decisions will prove to be accurate and increase your trading profits.