BDSWISS Review – A Reliable Friend for Trading Forex & CFD

We are inviting you to read this BDSWISS Review which is an old and famous Forex/ CFD broker.

Though it was famous for binary options, now they are not providing options trading anymore due to the recent ESMA changes.

They are more focused on Forex, Cryptocurrency, Shares, Indices, and Commodities. BDSWISS is one of Europe’s leading financial institution.

For a new trader, it is always a complex work to find out a trusted and reliable broker. Through this broker review, we are making this easy for you.

Since inception, it has been working with much sincerity and integrity. It has already gained a huge reputation and million traders’ trust. With much surprise, we have noticed that it is growing fast.

In this review, you will get to know about this broker’s unique features, regulation, information of the account types, advantages, disadvantages, and many more.

Warning: Country Restriction (Do Not Accept Traders)

Warning: Please note that BDSWISS Broker does not accept traders from the following countries – Afghanistan, Algeria, Bosnia and Herzegovina, Belgium, Canada, Crimea, Cote D’Ivoire, DPRK (North Korea), Guyana, Iran, Iraq, Myanmar, Papua New Guinea, Sudan, Syria, Uganda, Ukraine, United States, Vanuatu, Yemen, Lao People’s Democratic Republic.

BDSWISS Review

High Capital Risk Is Involved In Financial Trading

Since 2012, BDSWISS has been operating and providing wonderful service around the world. It is owned and operated by BDSWISS Holding PLC for EU countries and BDS Market Ltd for non – EU countries.

Their registered office is Apostolou Andrea Street 11, Hyper Tower, 5th Floor, 4007 Mesa Yeitonia, Limassol, Cyprus.

They have offices in Cyprus and Germany. The broker is regulated broker and gained trust through fair business policy. This CFD, Cryptocurrency, Forex broker has two regulations based on region.

That is why this broker is getting popularity every day. Having lots of clients is evidence of its reputation.

BDSWISS uses Web Trader and Meta Trader 4 Platform for both Desktop and Mac.

It has multiple mobile application services but, anyone can operate trade from his mobile phone through Android and iOS.

Why BDSWISS?

BDSWISS has been providing online trading services to almost a million clients worldwide. For many reasons, one should choose BDSWISS.

Among many, we are mentioning some key features which are important to know before depositing money.

As they are providing services for both the EU traders and NON-EU traders, so we separated features in two parts.

NON-EU TRADER

- Regulated by FSC

- Minimum deposit €/$/£ 200

- Zero Fees on Deposit

- Free Demo Account Forex/CFD

- Spreads from 1.0 Pips

- 0.00 Fees on Trade Execution

- Maximum Leverage – 1:400 (Forex)

- 250+ Trading assets

- 3 Account Types (Basic, Raw and Black)

- Hedging Allowed

- VIP support 24/7

- Max Lot size 50

- Minimum Position Size – 0.01 Lot

- Support of Economic Calendar

- Platform – Web Trader and MT4

- Available Mobile App – Android and iOS

- Fast withdrawal

- No commission

- Multiple language support

- Enriched education center

- Free Webinars

- Live chat and 24/7 customer service

- Free trading tools

- Islamic Account Optional

High Capital Risk Is Involved In Financial Trading

EU TRADER

- Regulated by CySEC

- Minimum deposit €/$/£ 200

- Zero Fees on Deposit

- Free Demo Account Forex/CFD

- Spreads from 0.4 Pips

- 0.00 Fees on Trade Execution

- Maximum Leverage – 1:30 (Forex)

- 250+ Trading assets

- 3 Account Types (Basic, Raw, and Black)

- Hedging Allowed

- VIP support 24/7

- Max Lot size 50

- Minimum Position Size – 0.01 Lot

- Support of Economic Calendar

- Platform – Web Trader and MT4

- Available Mobile App – Android and iOS

- Fast withdrawal

- No commission

- Multiple language support

- Enriched education center

- Free Webinars

- Live chat and 24/7 customer service

- Free trading tools

- Islamic Account Optional

We believe, these above mentioned features will help you to make your mind about this broker.

High Capital Risk Is Involved In Financial Trading

BDSWISS Regulation

As we already mentioned that BDSWISS is an regulated and reputed broker platform for Forex/CFD trading.

For EU countries, it has regulation from CySEC and their license number is 199/13.

It is also regulated by FSC (Financial Service Commission) for non – EU countries and their license number is C116016172.

Apart from these two, there are two more authorization given by regulatory bodies. These are:

- BDSwiss LLC is authorised and registered with the U.S. National Futures Association NFA ID: 0486419

- BDSwiss GmbH (Registration No. HRB 160749B) is the registered Tied Agent of BDSwiss Holding PLC in Germany.

BDSWISS Sign Up and Login Process

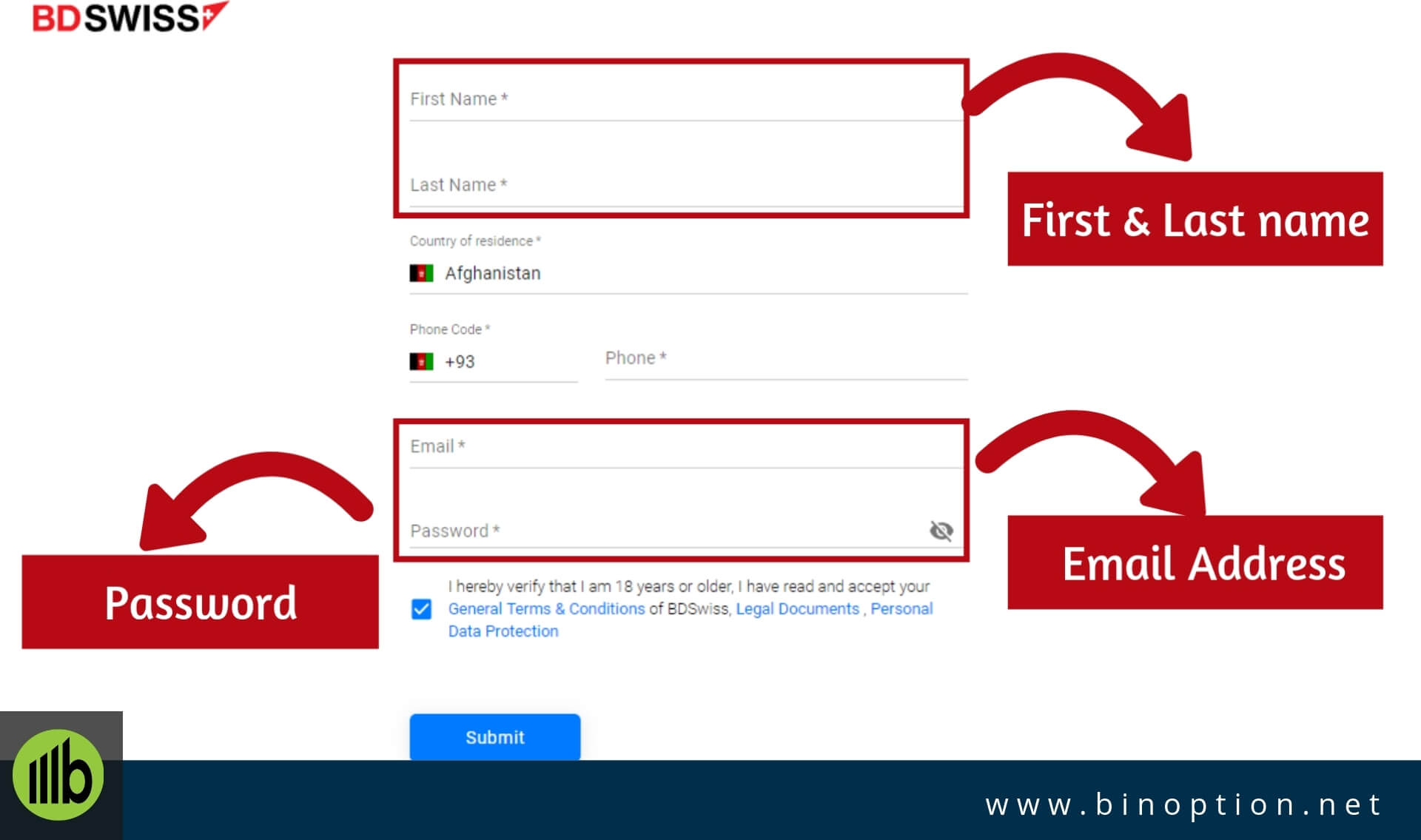

BDSWISS Sign-Up:

To sign up into the trading platform traders need to put their personal information like the first name, last name, country residence, e-mail address along with the password.

A welcome message will send to your Gmail account.

After agreeing with all the terms and conditions of BDSWISS, you have to fill up a form with a few information regarding your trading skills and financial status.

After filling up with all information, you are ready to trade with BDSWISS.

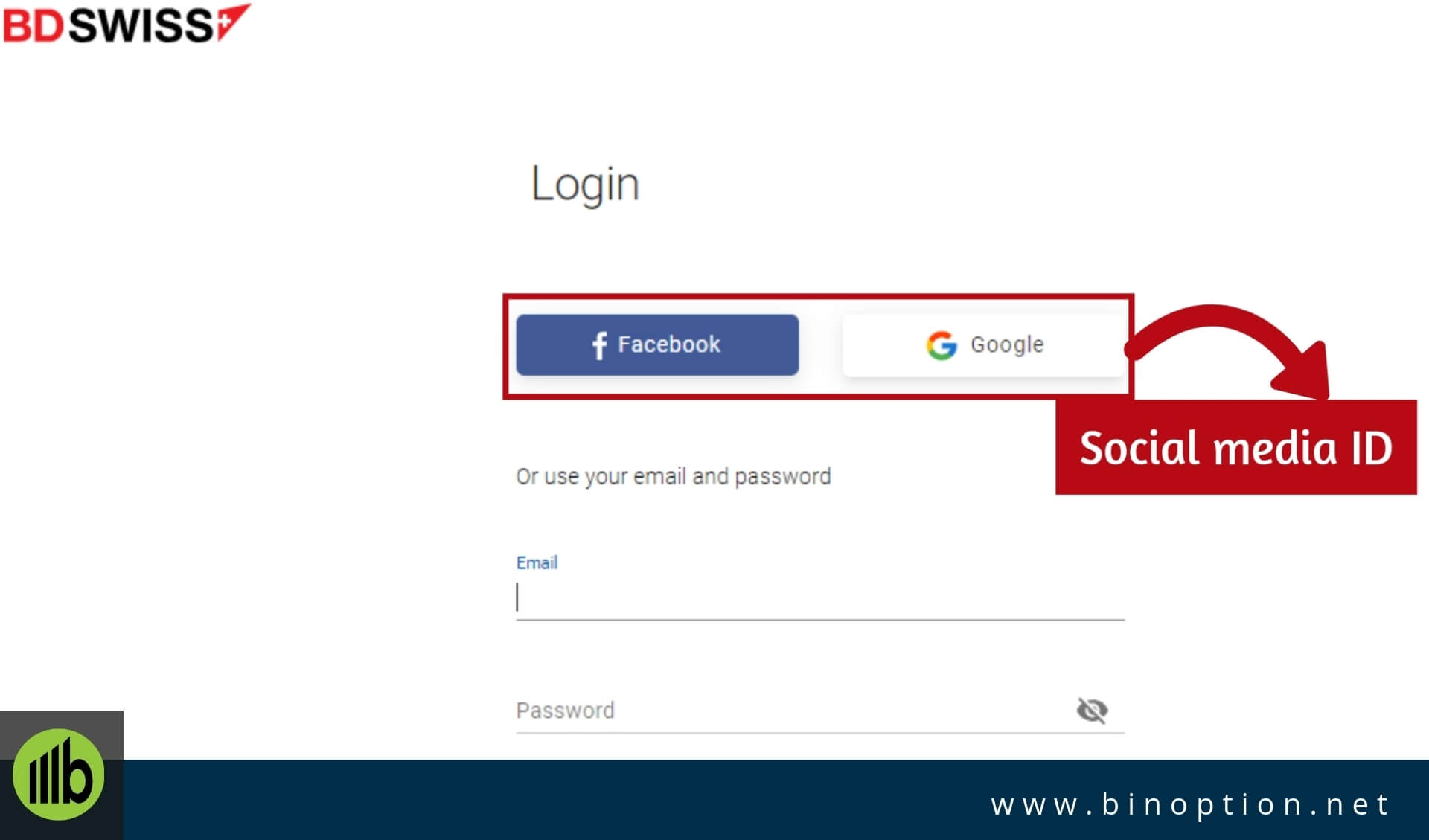

BDSWISS Login:

By using your Facebook and Google+ account, you will able to log in to the BDSWISS trading platform.

You can log in to the trading platform by giving your registered email address and password.

BDSWISS Account Verification

Being a regulated company, BDSWISS is obliged by law to verify their each and every customer’s account.

BDSWISS collect this information to protect your account and ensure that no unauthorized person can register an account on your name.

Proof of Identity:

Traders need to submit the photo identification like a passport or national ID card.

The attached file must be valid and clearly readable.

Proof of Residence:

A utility bill such as electricity, water, gas or landline phone bill or a bank statement, showing your name and address as listed on your application and issued within the last 6 months.

It is prohibited to submit mobile phone bills and bank receipts as proof of residence.

BDSWISS Demo Account

BDSWISS offers a demo account to their traders. You can use this demo account without any limited time period.

Practice account will help traders to trade without any fear of losing money.

You will get $10,000 virtual money which you can reset again. Traders can use the demo account in any of the platforms (Web, desktop, and mobile).

Any profits or funds in demo account is non-withdrawable.

It is possible to access in all features of the trading platform through the demo account. After depositing a minimum amount, you can easily switch to the real account.

Traders can practice trading in a virtual environment to improve their trading skills.

High Capital Risk Is Involved In Financial Trading

BDSWISS Forex Account Types

BDSwiss currently offers three account types: Basic, Raw, and Black for Forex & CFD trading. These accounts have been created for the needs of different traders.

The features are given below –

Basic

-

Leverage: 1:400

-

Min. Lot size: 0.01

-

Commission charges: No

-

Education Material: Free

-

Trading Alerts: No

Raw Spread

-

Leverage: 1:400

-

Min. Lot size: 0.1

-

Commission charges: Yes

-

Education Material: Free

-

Trading Alerts: No

Black

-

Leverage: 1:400

-

Min. Lot size: 0.1

-

Commission charges: No

-

Education Material: VIP

-

Trading Alerts: VIP

High Capital Risk Is Involved In Financial Trading

- Minimum Deposit: $200

- Leverage: As high as 1:400

- Leverage: As high as 1:30 (EU)

- Min lot size: 0.01

- Zero Fees on Deposits

- Free Education Material

- MT4, BDSwiss Webtrader, BDSwiss app iOS & Android

- Multilingual Support

- Free Trading Tools

- Free Webinars

- Islamic Account Optional

- Hedging allowed

- Average Spread: EURUSD – 1.5, USDJPY – 1.7, GBPUSD – 2.0, USDCHF – 1.7 (For both EU and NON-EU)

High Capital Risk Is Involved In Financial Trading

- Minimum Deposit: $1,000

- Leverage: As high as 1:400

- Leverage: As high as 1:30 (EU)

- Min lot size: 0.1

- Max lot size 50

- Zero Fees on Deposits

- MT4, BDSwiss Webtrader, BDSwiss app iOS & Android

- Multilingual Support

- Free Trading Tools

- Free Webinars

- Free Education Material

- Islamic Account Optional

- Hedging allowed

- Average Spread: EURUSD – 0.4, USDJPY – 0.4, GBPUSD – 0.4, USDCHF – 0.8 (For both EU and NON-EU)

- Minimum Deposit: $5,000

- Average Spread: EURUSD – 1.1, USDJPY – 1.3, GBPUSD – 1.5, USDCHF – 1.3

- Leverage: As high as 1.30 (EU)

- Leverage: As high as 1:400

- Min lot size: 0.1

- Zero Fees on Deposits

- VIP Education Material

- VIP Dedicated Support

- VIP Trading Alerts

- Free Access To Webinars

- Islamic Account Optional

- Free Virtual Private Server Service on request

- MT4, BDSwiss Webtrader, BDSwiss app iOS & Android

High Capital Risk Is Involved In Financial Trading

Asset Index

Over 250 assets are available at BDSWISS including shares, indices, forex, cryptocurrencies, and commodities.

They have 50+ Forex Pairs, 15+ Cryptocurrencies, 5+ Commodities, 10+ Indices and 140+ Equites.

Another key point is that BDSWISS does not charge any transaction fees on trade execution.

In Forex trading, spread starts from 1.0 pips on popular currency pairs. For example, EUR/USD is one of the popular currency pairs highly traded in the Forex market.

ENI, IBM,DAIM, DBFRA, VODAFONE, BARCLAYS, EXXON, JPMORGAN, FACEBOOK, INTEL, GE, TWITTER, UBS, YAHOO, EBAY, MCDON, ALIBABA, APPLE, BP, CITI, COCA COLA, HSBC HOLDINGS etc.

DAX, DOW, DUBAI FINANCIAL MARKET GENERAL INDEX, FTSE 100, KUWAIT GENERAL INDEX, NASDAQ, S&P 500, TADAWUL etc.

USD/JPY-OTC, USD/CHF-OTC, USD/CAD-OTC, GBP/USD-OTC, GBP/JPY, GBP/CHF, GBP/CAD, GBP/AUD, EUR/TRY, EUR/NOK, EUR/GBP, EUR/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY etc.

GOLD, SILVER, OIL, COPPER etc.

Bitcoin, Litecoin etc

High Capital Risk Is Involved In Financial Trading

BDSWISS Trading Platform Overview

BDSWISS offers MT4, MT5, and WebTrader trading platform for its traders.

You can download to your desktop and mobile;e device to perform the trade.

BDSwiss itself uses the time zone UTC +1. The prices displayed in the Meta Trader 4 platform refer to the server time of UTC +2. Both time zones change to UTC +2 or UTC +3 during the summer time.

Each trading platform offers unique features for traders. However, the WebTrader platform exclusively developed in-house to fulfill their client’s needs.

Traders cannot open the MT5 trading platform with MT4 login credential. You have to open different trading accounts for them.

They have an MT4 trading platform where traders can perform their trade. The MT4 platform is quite familiar to the traders.

You can place your trade on Meta Trader 4 on Windows, Mac, and Web.

The total trading platform is user-friendly. You can easily switch to your real account from the demo account. You can customize the trading window according to your preference.

Traders can select assets from the asset’s lists. The list will show you the current asset’s price and the change in 24H. In the market watch panel, you will find bid price and sell prices of the most popular trading assets.

In the right side, you will find your preferred asset with a fixed spread and leverage. The ratio of the leverage depends on the asset’s type.

Traders can protect their trades at all times with good risk management, by setting a Take Profit and Stop Loss on every trade.

You can check your trading position details by clicking on the position button. It will show your open, pending, and closed orders.

You will find a wide range of trading indicators, trading charts, and other trading tools. Find your favorite chart types, technical analysis, and graphical tools form the trading platform.

Negative balance protection will help traders to limit your lose more than your original deposit.

You can monitor your account balance, equity, and free margin on the right side of the online trading platform.

Traders can set the time interval from 1 minute to 1 month.

MT5 platform is the latest trading platform that offers advanced trading tools and indicators.

In fact, it enables traders to keep control of their trades. It also helps them to make informed decisions using cutting-edge analysis.

It enables clients to trade an extended number of CFD trading instruments from various assets classes.

Moreover, you will have full access to your account and order history.

Additionally, the platform offers an internal mailing system for traders. Furthermore, you can enjoy a lot of unique features like:

- Automated trading with EA

- Ability to display 100 charts simultaneously

- Over 80 Technical Indicators

- Analytical objects more than 40

WebTrader platform is designed by the BDSWISS team to take better care of their growing user base.

A cutting-edge interface allows traders to execute a simple and instantaneous trade.

It features unique trading indicators and charting tools.

Additionally, it also allows traders to perform automated trading.

High Capital Risk Is Involved In Financial Trading

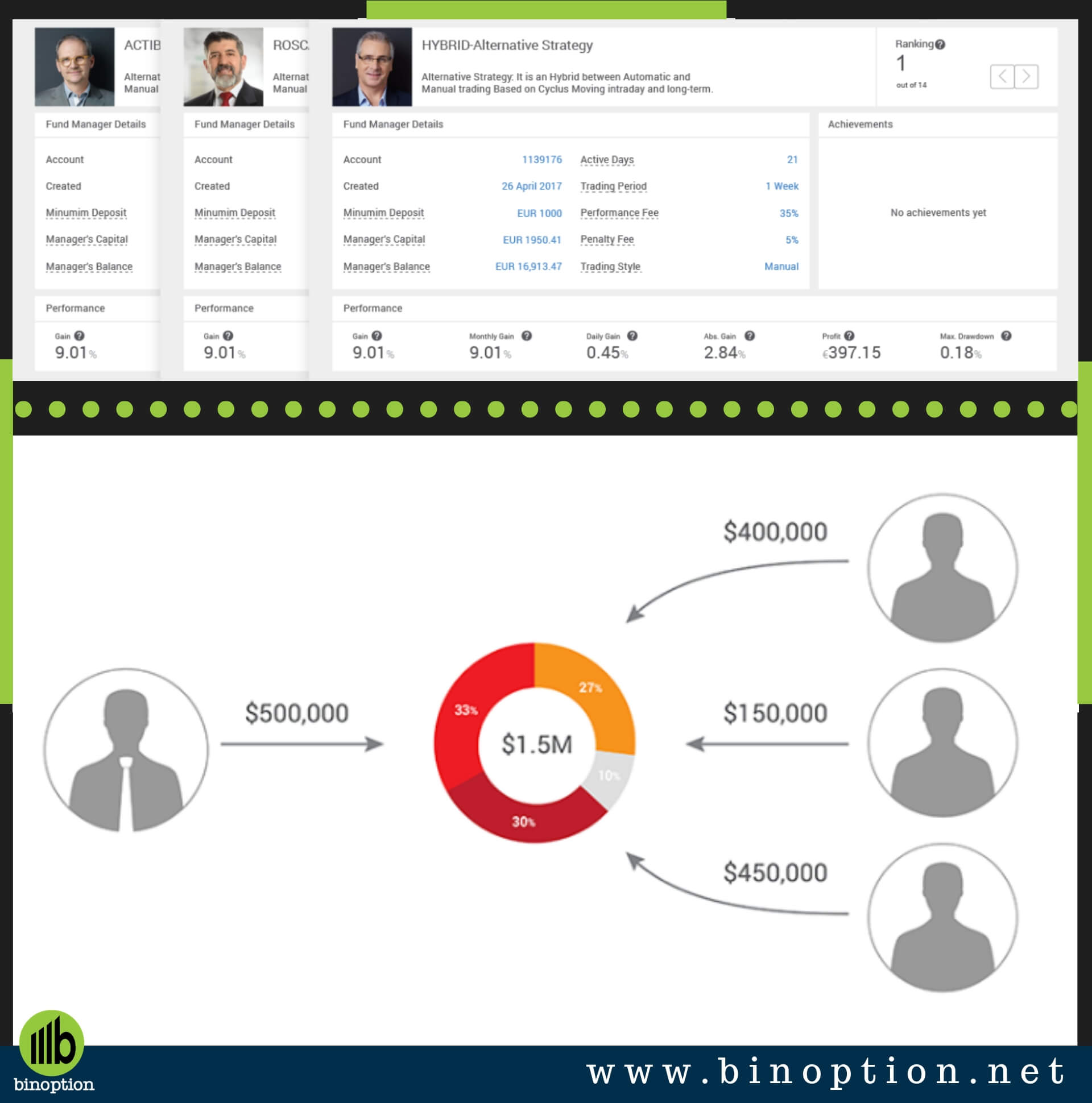

Wealth Management Program

Traders can put the trading capital to maximize the rate of return.

In the wealth management program, there will be an account or fund manager who will help you to increase your profit on behalf of you.

You can act in both ways; as a seasonal fund manager or an investor.

BDSWISS wealth management program works in three below steps.

Traders need to choose a trusted partner. You can either choose one fund manager or multiple fund managers to invest your money. BDSWISS is offering complete transparency by giving a number of performance metrics. The metrics will help to find out the best Fund Managers including their success rate, their current balance, the strategy they will be using, their total profits and their fees and charges, among others.

High Capital Risk Is Involved In Financial Trading

BDSWISS APP

You can now trade your favorite trading asset with the help of the BDSWISS trading app. The app is translated in more than 20 native languages.

You can perform trade in your mobile device as well as the desktop device. The trading platform is similar to the web platform.

BDSWISS gives you absolute freedom to trade anywhere in anytime.

You can download MT4 trading platform in your android and iOS device.

BDSWISS Trading App – Desktop:

Traders can download MT4 for Desktop device. The trading app is available for your Windows and MAC.

The BDSWISS Forex MetaTrader 4 trading platform is designed for traders who wish to trade in the financial markets.

You can access the trading platform instantly without any loading time.

For downloading the app, traders need to follow a few simple steps.

This software is using Wine and WineBottler which are free and open source software released under the LGPLv2.1+ license.

The mobile application will give you access to trade CFDs on currency pairs, commodities, indices and stocks.

You can monitor your trading charts, can deposit your initial balance and withdraw profits.

The BDSWISS mobile app is offered in both Android and iOS. The mobile app is very clean and attractive to the traders.

The App is only available on the App stores for the iOS devices and on the Google Play store for Android devices.

In 2018, the broker platform received “Best Trading App 2018 Award” by Mobile Star Awards.

High Capital Risk Is Involved In Financial Trading

Trading Academy & Education

They have a wide range of education portion for the beginner traders as well as the intermediate and advanced level traders.

They mainly provide video courses for their traders. Traders will get educational resources based on Forex and CFD trading.

The goal is to give traders a basic understanding of trading. You will get knowledge on different types of assets, trend analysis, charts, tools, indicators, and so on.

Those who are new in the trading field can enjoy the facility of having a personal trainer with our paying a single penny.

With the help of a risk management strategy, traders will able to control their trading risk and can develop their own money management system.

In Educational Material you will also get –

- Forex Glossary

- Forex Basics Lessons

- Daily and Special Events Webinars

- 121 VIP Sessions

- Market News and Articles

- Forex Trading Videos

Analysis And Tools

At the BDSWISS website, you will find the analysis section from where you can select your necessary trading tools.

The total analysis section is designed with six different parts.

Through the economic calendar, traders will get to know about the recent trading market economic data. It is a great source of trading announcement.

It will inform traders about when the world’s biggest financial announcements will take place as well as what the projected value will be

BDSWISS trading alerts will help traders by providing daily free alerts with analysis on possible price direction in buy or sell terms along with entry and stop levels.

You can access to the VIP trading alerts by providing your name. account number, contact number, and email address.

In the market news section, you will find all the latest market news which will help you to perform your trade.

Depending on the market news, the trading asset’s price fluctuates.

In the trader’s journal part, you will find different articles which are based on how different asset classes works, how to perform a trade in the bear and bull market, etc.

Market outlook part is the FX/CFD market forecasts by BDSWISS’ analysts.

It changes from year to year. You can download the market forecast PDF by submitting your personal information like name, email, contact number, and country name.

BDSwiss has expanded its tool-kit arsenal with the integration of Autochartist.

It is a user-friendly and intuitive interface that monitors market 24 hours a day, and automatically alert traders whenever new trading opportunities are identified.

You can perform a profitable trade with the help of Autochartist.

Live Webinars

Trading webinars is helpful for all types of traders acquire trading knowledge.

It is a place where you can learn about trading from expert traders and also discuss your problems or share your thoughts with different traders.

Trading webinars will enable reality based tips and corrections for traders. It is also prevent misconceptions and provide interactive opportunities among traders.

At BDSWISS, traders will get opportunity to attend in the webinars with all expert traders to enrich their knowledge to the financial market.

Their main goal is to give trader’s access to first-rate market education.

From each webinars, you will learn how to interpret charts, develop your own strategy and watch experts trade key market events live.

You will find the live trading schedule from their website. To join webinars, traders need to complete registration by giving their name and email address.

A webinar organizer, will communicate with you regarding event and their other services.

High Capital Risk Is Involved In Financial Trading

Deposit Method

We have found the transaction method easy, smooth and secured. While opening your account you van select or choose your desire currency.

It uses SSL encryption to protect all kinds of transaction.

The minimum deposit is $200. However, the deposited amount will depends on your account types.

It is not necessary to deposit immediately after signing up at BDSWISS. You can deposit later after completing trading practice with demo account.

BDSWISS supports 150+ depositing methods. Depositing money can be done using any banking channel including Visa, Master Card, Bank Wire, Maestro, Krill Netelar, Sofort, Paysafecard, Ukash, Giropay etc.

There is no fee for depositing money.

It will take no time if you deposit your amount without using any bank channel. Bank wire deposit may take between 1-4 working days to reach BDSWISS and are processed immediately once they are receive.

BDSWISS Withdrawal

Withdrawal is also easy, fast and hassle-free.

It takes two days to process a withdrawal request.

In terms of withdrawal, a trader has to submit some documents for security reason.

You need the following documents to verify your account:

- Proof of identification: Provide any government identification such as passport or identity card.

- Proof of address: Provide any utility bill such as electricity, water, gas or internet bill. The address must be clearly visible on the bill.

- Appropriateness test: BDSWISS conducts an appropriateness test and expects the customer to honestly answer all the questions in the test.

Using the same banking media, withdrawal can be done.

As per the information which is written to their website that all withdrawals are processed within 24 working hours by BDSWISS.

Except bank wire withdrawal process, there is no minimum withdrawal amount required for the traders.

Note: 10 EUR fee will apply to any bank wire withdrawals under 100 EUR and any other withdrawals amounting to 20 EUR or less. For bank wire international payments, the minimum withdrawal amount is 50 EUR after the deduction of the 10 EUR basic fee.

For SEPA transfers there is a minimum withdrawal amount of 5 EUR after the deduction of the 10 EUR basic fee.

The time duration of payout is 2-7 business working days. The average withdrawal time 5hrs.

But BDSWISS suggest to their traders for using wire transfer for withdrawing their funds because this payment method is more secure than any others.

Withdrawal through bank wire costs $25 fee.

If there is any problem regarding withdrawal, you can ask their help.

Help and Customer Support

Customer support of BDSWISS is very proactive and cordial. By several ways, it provides customer service day and night.

Traders can be connected with them via WhatsApp, Telegram, Email, Call back, and Live Chat.

They have multi-language support number and it is 16 languages in different numbers.

There is also a live chat room. You will get really a quick reply from their side. If you knock them using live chat you will get an answer right away.

So, we are giving BDSWISS thumbs up in terms of customer service.

BDSWISS Advantages

While dealing with this trading broker, we have found numerous advantages.

The main advantages is their wide range of trading indicators. Trading indicators will help traders to predict the future asset price.

The strict regulation process makes this broker reliable.

They offers multiple trading accounts which will help traders to choose one depends on their trading skills. There is no hidden charge applicable while depositing money.

The customer support team is dedicated and always there for the traders.

Drawback

We have found some drawbacks of BDSWISS. We are sharing those findings with you here.

They should have think about the proprietary platform.

In their website, you will not find any information about the demo account. However, after registration you’ll get the demo account.

We think more information are needed to add on the website.

So that a new trader can get all the information while surfing BDSWISS website.

Except these things, we believe this broker is good and trusted.

Is BDSwiss Legit or Scam?

It is really satisfactory news that BDSWISS is growing fast since its inception.

We are pleased to learn that it has excellent customer track record.

We have checked thoroughly and drawn a conclusion in our BDSWISS Review that this broker is trustworthy, reliable and transparent.

It is not a scam rather a reliable friend for new as well as old traders.

We are highly recommended this broker.

Good luck to all of you!